2020 is halfway over and we now have a full quarter of data about how the real estate market is responding to the worldwide pandemic. Dive in for a look at the factors affecting the market, how San Diego compares to the rest of the nation, and what to expect over the next year if you’re thinking of buying or selling (or both) in San Diego.

More...

Per the figures from last week, 8.39% of mortgages are currently in forbearance. This number has been declining slightly week over week, but of the loans exiting forbearance last week, most were going into deferment or trying to get a loan modification rather than simply getting back to payments as usual.

By comparison, at the peak of the 2008 crash, about 20% of mortgages were in default. Default is different than forbearance, but with forbearance repayment terms varying depending on bank and loan type, it may not be a giant leap from forbearance to default to foreclosure for many of these struggling homeowners.

The good news is that even in the worst case scenario, the numbers won’t be half as bad as 2008 in terms of distressed real estate sales.

Unemployment numbers have also continued to slowly decline (11.1% is the most recent statistic), but 1.3 million people filed for new benefits last week, a level that is still well above records from previous economic downturns, and that doesn’t count the additional 1 million self-employed people who just applied for the new Pandemic Unemployment Assistance program.

With lots of uncertainty looming in terms of jobs and roll backs on shutdowns, this will continue to be an important factor affecting the real estate market.

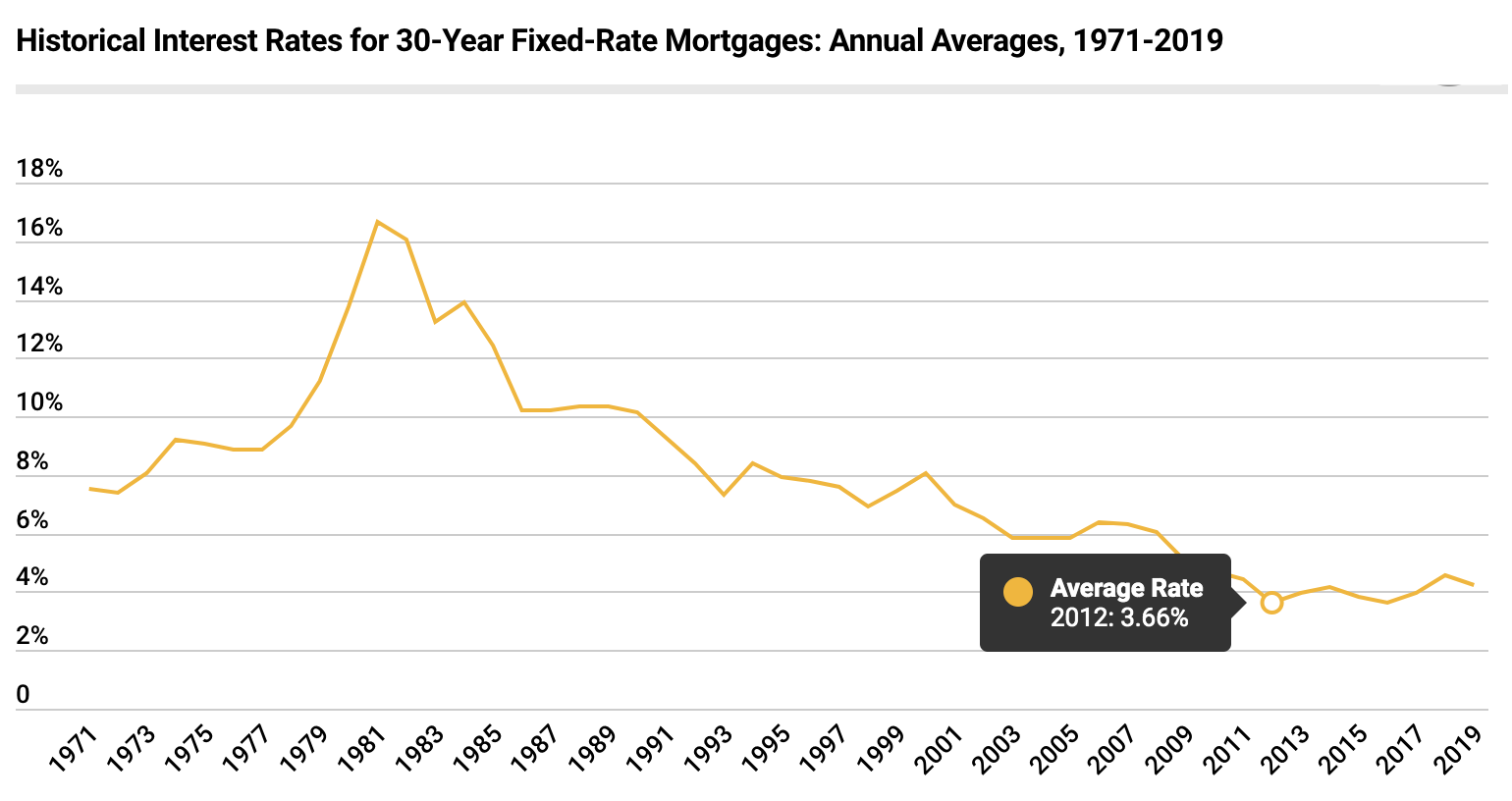

The Federal Reserve has been taking extraordinary measures to stimulate the economy and due to its policies, mortgage interest rates are currently the lowest they’ve been in almost 50 years. The average APR for a 30-year fixed mortgage right now is 3.45%, and since 1971, we have only seen anywhere near this low briefly in 2012 and 2016.

Mortgage applications were up 33% last week over the prior year. This rate environment is definitely driving demand in the housing market, but unfortunately, stricter lending guidelines have made it harder for some people who would be otherwise qualified to get a loan. The Mortgage Credit Availability Index dropped again in June, and credit supply has dropped over 30% since February.

Fewer lenders are currently offering “jumbo” loans, which in San Diego are loans for more than $701,500, and for those lenders still offering jumbo loans, requirements for credit scores and the amount of money you need in savings as “reserves” have increased.

Lenders have also implemented new Covid requirements, where they may confirm that the pandemic hasn't caused any interruption in the borrower’s income, up until the day of closing escrow. And if the borrower’s credit report shows any interruption in the payment of bills, rent, or forbearance on credit card or mortgage payments, that will generally trigger an automatic denial.

Investment property loans have all but disappeared at the moment, but if you’re interested in 1-4 unit properties and you’re willing to make one of the units your home for the next year, you can get a "primary residence" loan and use the income from the other units to bolster your loan qualification. I highly recommend this investment strategy.

The silver lining is that stricter lender guidelines help protect us from a housing market collapse like 2008. Bottom line, if you can still qualify for a loan, it's a no brainer to start shopping for a home right now. Comment if you need a referral to a couple of amazing lenders.

As renowned San Diego real estate economist Alan Nevin reminds us, jobs drive the economy, and real estate is local.

When recently asked about the pandemic’s expected effect on the San Diego real estate market, Nevin emphasized the “amazingly strong safety net” we have here in terms of employment by industry. Many other metropolitan areas have one or two main economic drivers, he noted, and when one industry fails, it collapses the entire local economy.

In San Diego, over half of our jobs are what Nevin called “safety net jobs,” which will keep the economy moving until all businesses can reopen safely, even if the shutdown takes longer than anticipated.

22% of jobs are in government or the military, which have not been as affected by the pandemic as other sectors. 7% of jobs are in manufacturing, and most of that is aerospace, government contracting, and electronic-related, and those plants have not shut down either. Round this off with 12% of jobs in health care and 9% in professional, scientific and technical fields, which have also remained largely intact despite the pandemic.

San Diego has lost 195,800 jobs since last year according to the latest data released by the EDD, with the majority of these losses in the leisure, hospitality, transportation, and sales industries. This is a devastating number to be sure, but so far it hasn't seemed to affect the number of buyers shopping for San Diego homes.

With a strong jobs market and ridiculously low mortgage rates, many San Diegans can still afford and qualify for a mortgage, and home buyers are out in force despite the pandemic.

The number of homes going into escrow each month was up 22.9% in June over last year, while at the same time there were 44.6% fewer homes for sale.

We’ve also seen an influx of buyers fleeing high density, expensive cities such as San Francisco and New York, as well as international buyers. San Diego is relatively affordable compared to these places and the quality of life obviously can't be beat.

The problem is that while demand has increased, supply has decreased. The San Diego real estate market has suffered from a chronic lack of housing inventory for years, and the pandemic has further exacerbated the housing supply as sellers have pulled their homes off the market out of uncertainty and fear.

The median home price is up 2.4% over last year, which is a much smaller increase than we’ve seen in recent years (it’s been around 5-7%/year), but it is a healthy increase and demand will likely continue to push it in a positive direction.

Increased demand is also causing homes to sell more quickly than this time last year, with an average of 27 days on market in June, down from 29 a year ago, a 6.9% drop.

Foreclosures and short sales have all but ceased to exist in San Diego the past few years and these super low levels haven’t changed during the pandemic, so far.

Realtors calculate the number of months of housing inventory to gauge whether the market favors buyers or sellers. This is measured by dividing the number of homes currently for sale by the average number of homes that have gone into escrow (“pending sales”) each month for the past 12 months. For reference, 6 months of inventory is considered a balanced market, favoring neither buyer nor seller.

In June in San Diego County there were 4,144 homes for sale and 3,645 went into escrow. At this rate, the market inventory will sell out in a little over a month. Using the 12-month average of monthly pending sales, we only get up to 1.5 months of inventory, which is extremely low.

What we’re in right now is an extreme seller’s market given the supply and demand dynamics, and any active buyer in this market, especially anywhere near the county’s median price point of $614,500, will surely tell you stories of bidding wars against multiple other offers.

Surprisingly or not, despite the tightening of credit requirements for loans above $701,500, the $1.2-2 million price point is the strongest in our market. There is a whole lot of cash in San Diego and it just keeps pouring in.

This is of course a generalization for the county as a whole, and different zip codes and neighborhoods have unique supply and demand dynamics, but none are anywhere near having 6 months of inventory. Coronado has the most inventory at about 4.6 months, while smaller desirable zip codes have less than one month’s worth of inventory.

There will be opportunities for buyers in the coming months, but in general there is no “coronavirus discount” when it comes to San Diego real estate, at least not yet. Read ahead for the potential wildcards in the market in the next 6-12 months, and my forecasts and recommendations for buyers and sellers.

Naturally, home buyers are hoping for a dip in prices, and although the current data doesn’t suggest that’s going to happen in San Diego anytime soon, we can expect at least some additional inventory coming to market in the next 6-12 months from two specific sources: (1) homeowners who have fallen into foreclosure; and (2) rental property owners who don’t want to be landlords anymore or whose tenants aren't paying rent and can’t be evicted.

The question is how much inventory this will be and whether it will tip the San Diego supply and demand dynamics significantly enough to actually bring prices down.

The $600 per week federal unemployment benefit is set to expire on July 31, 2020, and it likely either won’t be extended, or will be modified to cap payment at 100% of the person’s normal wages. If it’s not extended in any manner, things could get ugly for these two groups.

Federally-backed mortgages (about 70% of mortgages) are currently not allowed to pursue foreclosure, but that protection expires on August 31, 2020. From that time, it would be at least 4-6 months for a loan in default to reach foreclosure, even if fast-tracked.

There have been reports of national mortgage companies posting foreclosure-related job openings, suggesting they’re expecting a boom in foreclosures, but on a local level, buyers shouldn’t be too focused on getting a foreclosure deal for 3 reasons:

(1) The “safety net” of employment in San Diego makes it likely our foreclosure rate will be far lower than the national average;

(2) Even if we applied the federal data to San Diego and made some very liberal worst-case assumptions, and the number of new listings per month doubled from approx. 4,000 new listings per month to 8,000, that would still only be about 3 months of inventory, which is still a seller’s market; and

(3) Banks have become much more aggressive about trying to get fair market value for foreclosed properties, to the point that considering the risks of buying a foreclosed property, the margins for getting a great deal are pretty thin.

The brunt of the burden on the San Diego real estate market is being felt by landlords whose tenants aren’t paying rent and can’t be evicted. Emergency laws meant to protect people who can’t pay their rent due to Covid have ground all evictions to a halt in San Diego, Covid-related or not, and it’s very uncertain how long this will last.

In April, the California Judicial Council enacted a sweeping rule prohibiting any eviction lawsuit statewide from commencing until 90 days after the Governor has lifted his state of emergency, regardless of whether the reason for the eviction has to do with a Covid-related hardship. With no end to the pandemic in sight, the likelihood of Governor Newsom lifting his state of emergency order before the end of the year is virtually zero.

San Diego enacted local laws allowing rent deferment and an eviction moratorium through September 30, 2020, only for those units which can show a Covid-related hardship. But the Judicial Council’s rule takes precedence, so San Diego landlords won’t be getting relief anytime soon.

Neither of these rules prohibits pre-Covid evictions from continuing, but the San Diego courts have been extremely conservative in interpreting the Judicial Council’s rule. They are not setting any trial dates for pre-Covid evictions and have only allowed default judgments in pre-Covid evictions in the rarest of circumstances. Even in emergency cases where tenant behavior is threatening the health and safety of others, the courts have been resistant to allowing evictions to proceed.

Prominent San Diego landlord attorney Rachael Callahan said that approximately 90% of the eviction cases she’s seeing have nothing to do with Covid. “Most of my clients who have tenants experiencing Covid-related hardships have been able to work out payment agreements to ensure their tenants are paying what they can and won’t end up out on the street, but the $600/week federal employment benefit has probably been a big help.”

Callahan’s outlook on when landlords will be able to remove non-paying tenants whose failure to pay is unrelated to Covid: “Winter would be very optimistic, but more likely early next year, by which time many of my clients will not have received rent for a year or more.” Landlords seeking help can reach out to Callahan at her firm San Diego Evictions: www.SanDiegoEvictions.com

Those with more units may be able to weather these woes, but smaller investment property owners who have mortgages or rely on that income for their monthly expenses are going to continue to suffer as the court system tries to figure out what to do. Even once things get moving again, the backlog of cases is going to make evictions more costly and time consuming for probably all of 2021.

This is all on top of the statewide rent control and "just cause" eviction law that went into effect this year. Whether through foreclosure or frustration, we are sure to see some of this inventory coming to market in the next year.

Just as Alan Nevin predicted before the 2016 election, neither of these factors will have a significant effect our housing market in San Diego. Stocks can be overpriced and politics can be tumultuous but jobs drive the economy and the supply vs. demand dynamics in San Diego point to stable/rising home prices now just as they did in 2016.

Forecast: Supply Trickles In, Returning to “Normal” San Diego Levels Soon

The good news is, we're not going to have another housing crash in San Diego. The supply of San Diego homes lags so far behind demand that even if the “perfect storm” of foreclosures, job loss, and crippled landlords brings a huge amount of inventory to the market, the demand will gobble it up.

It would take months on end of supply flooding the market before our years-long housing supply shortage is reversed, at least as long as mortgage rates stay so low, which is projected through all of 2021. However, we should see the market come into greater balance, and despite the competition, the current market poses so many incredible opportunities, buyers shouldn’t be deterred.

I predict an increase in inventory over the next few months as sellers continue to realize that homes can be sold safely and effectively during the pandemic. Virtual marketing of homes has progressed in leaps and bounds. New home builders in San Diego are ramping back up as well and demand is high for these homes.

In the coming months we should inch closer to 3 months of inventory, which is a normal level for San Diego (albeit still low). There will be a normal seasonal lull in inventory over the holidays (which is a great time to buy a home), and then we’ll probably see inventory tick back up in February/March, with hopefully more inventory balancing the market for the rest of 2021.

Advice for Buyers: Get Your Ducks In A Row

Home prices in San Diego are currently appreciating at the lowest rate we’ve seen since 2012, and mortgage rates are lower now than they’ve ever been. If you are serious about buying a home, get started now so you'll be ready to jump on a good deal when it comes up.

Don’t forget that you can get a conventional loan with as little as a 5% down payment. Talk to a lender about your financing options, hire a Realtor to help focus and strategize your search, and get ready to change your life.

Advice for Sellers: Don't Miss This Market

Take advantage of the ridiculously low inventory and rock bottom mortgage rates as soon as possible. There is almost no competition right now for your property, and if you need to buy a new home after you sell, it’s never been a more perfect environment.

As a seller, you have the upper hand to negotiate the timeline on the sale you need, or rent-back for a few weeks after closing, and as a buyer, you may experience some competition but with cash from the sale and the lowest mortgage rates we’ve literally ever seen, you’ll get back into the market at the perfect time.

And if you are 55 or older, ask me about how to take your property tax payment with you, rather than letting your property tax bill skyrocket when you buy a new home.

Good luck to all! If you'd like to discuss your real estate goals in more detail, use the button below to book a free strategy session with me!

-Lauren Empey, Attorney & Broker/Owner, Empey Realty

Sources:

1 - Mortgage Bankers Association, July 7, 2020, Press Release: Share of Mortgage Loans in Forbearance Decreases for Third Straight Week to 8.39% https://www.mba.org/2020-press-releases/july/share-of-mortgage-loans-in-forbearance-decreases-for-third-straight-week-to-839

2 - Federal Reserve, November 2008, The Rise in Mortgage Defaults, https://www.federalreserve.gov/pubs/FEDS/2008/200859/200859pap.pdf

3 - New York Times, July 9, 2020, 1.3 million workers filed new state unemployment claims last week, https://www.nytimes.com/live/2020/07/09/business/stock-market-today-coronavirus#1-3-million-workers-filed-new-state-unemployment-claims-last-week

4 - State of California, EDD, June 19, 2020, Nonfarm Payrolls Up 18,200 Over the Month; Down 195,800 Over the Year, https://www.labormarketinfo.edd.ca.gov/file/lfmonth/sand$pds.pdf

5 - Mortgage Bankers Association, July 9, 2020, Press Release: Mortgage Credit Availability Decreased in June, https://www.mba.org/2020-press-releases/july/mortgage-credit-availability-decreased-in-june

6 - San Diego Assocation of Realtors, Monthly Indicators, June 2020, http://sdar.stats.10kresearch.com/docs/mmi/2020-06/x/report?src=page