The San Diego real estate market has gone into such a frenzy this year, even after record breaking numbers last year, leaving home buyers bewildered and sellers scrambling to figure out how to cash in without becoming homeless. Here’s all the data you need to know, along with my predictions for the next 12 months and my top tips for aspiring home buyers and sellers.

More...

The median detached home price in San Diego last week was $885k, up from $705k the same week last year, an increase of 25.5%! That’s a ton of equity to gain for the average San Diego home owner in the last year. Median days on market is down to 7 days, from 14 days this time last year.

The total number of closed sales year-to-date is up 25% from last year, but this small increase in inventory is nowhere near enough to satisfy the buyer demand. San Diego County has a chronic shortage of housing units and we’re doing abysmally at rectifying that. San Diego is one of the most difficult areas to build, permitting costs are exorbitant, and yet many of our political representatives are actually supporting measures which will further stifle development. This is a systemic problem and won’t be rectified anytime soon.

Rock bottom mortgage interest rates are driving buyer demand in markets across the country, coupled with people's newfound ability to work remotely, which is especially impacting the San Diego real estate market, since this is such an amazing place to live. There is a ton of cash flowing into San Diego from the Bay Area, Chicago, and the east coast, even in the multi-million dollar price point. The secret about San Diego is out, and the recent home prices reflect that.

Most sellers are seeing multiple offers on their properties, but there are some sellers who mistakenly think that they can slap any ridiculous price on their homes and it will sell. It won’t. Buyers are savvy, have access to the market information, and especially when they are paying such a premium, they are intent on getting the best possible deal. So we are seeing about 20-25% of the "for sale" inventory with price reductions and about as many escrows cancelling if sellers won’t give concessions on repairs or buyers simply find something they like better.

For homes which are priced right and offer the most important features to buyers, sale prices are ending up $50-300k over asking! The most important feature to buyers now is plenty of space--outdoor spaces to entertain and indoor places for work and exercise. North County used to be a comparatively affordable area in the county but now Encinitas and Carlsbad are among the most in-demand areas in the county.

It's basically mandatory for a buyer to waive the appraisal contingency in the current market, which means the buyer has to agree in advance that if the appraised value comes in below the offered price, they will pay the difference in cash (because the loan will only be approved based on the appraised value). This is a risky strategy, and in some cases buyers are having to bring an extra $100k or more on top of their down payment.

Investors are also driving demand, as rents are up almost 10% from pre-pandemic levels. Even though some tenants are still protected from being evicted for nonpayment of rent under state and local Covid regulations, income property is still looking like a good investment, especially given the low yield on alternative investments such as bonds.

San Diego continues to gain jobs and although we still have a ways to go before we get back to pre-pandemic levels, things are moving in the right direction, with significant growth in the biotech and life sciences sectors. Office and commercial space vacancies are down and lease prices are rising. Amazon has already expanded into San Diego and Apple is planning to move thousands of employees to a new facility in the UTC area before the end of the year, citing more affordable housing options than the Bay Area, which is quickly fading to a thing of the past.

Governmental stimulus continues to bolster the market and the Fed has indicated that they won’t be changing this monetary policy for at least the next year, especially if we start to see a second surge in covid.

Although there are several non-inflationary factors driving the surge in real estate values, there is a concern that the rapidly increasing home prices we’re seeing is not necessarily a sign that the homes are worth that much more, but that the dollar is worth that much less. This could be a sign of the onset of a major period of inflation, which would further support the value of real estate as an investment because if we are entering an inflationary period, leaving cash on the sidelines is not a wise option.

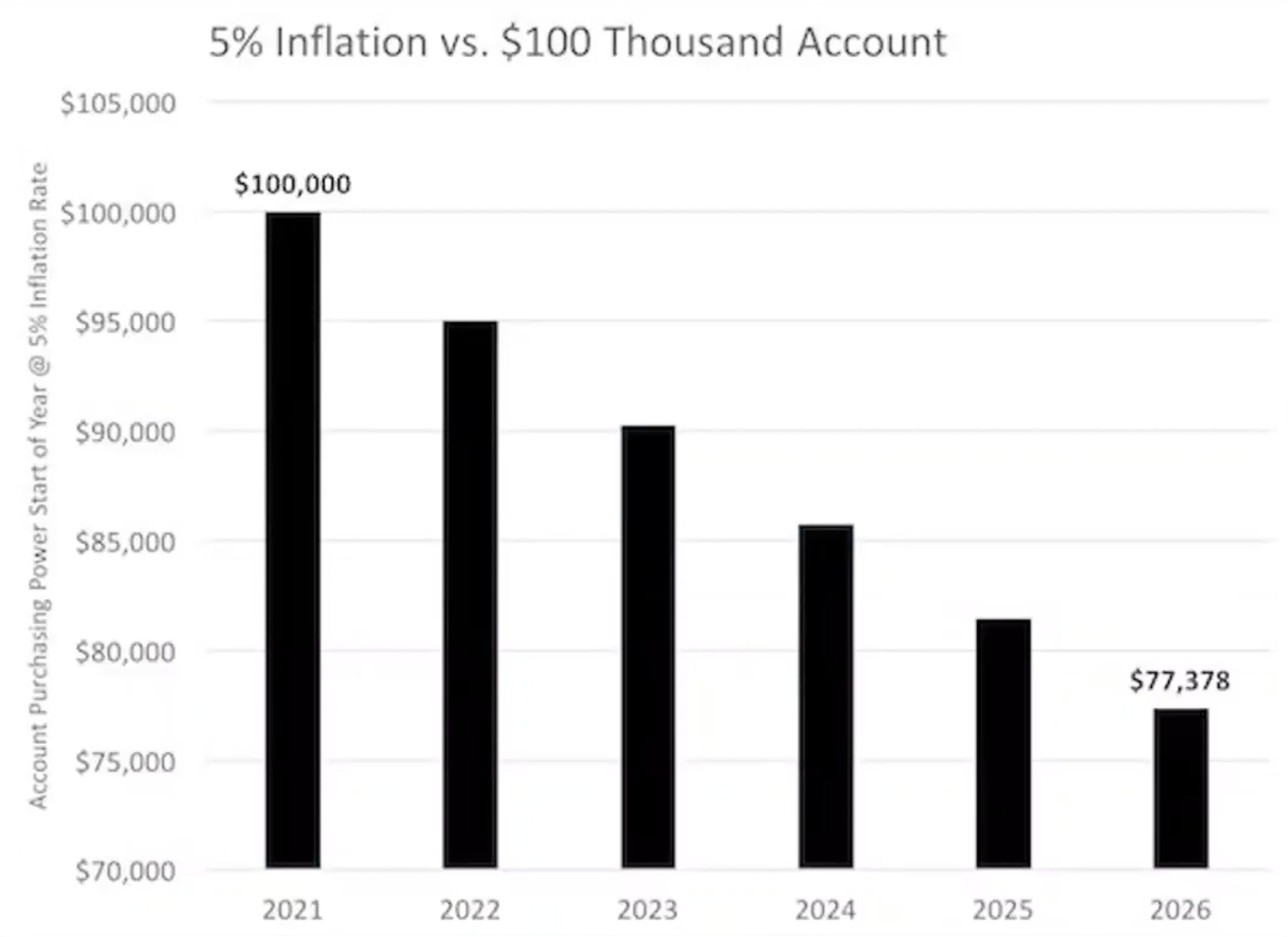

This is what happens to your money in real, inflation-adjusted terms at only 5% inflation, if you just let it sit in the bank.

If we do end up with entrenched inflation, the government won’t be able to sell bonds at the current interest rates, so they’ll have to raise rates or directly purchase those bonds themselves, which ends up in an upward spiral of inflation. We don’t know if the accelerating inflation is transitory or not, but if it’s not, the home prices we’re seeing today that have us scratching our heads, asking if these prices are too high, are going to look like a real bargain in a few years.

All the factors are in place to support a continuing bull market in San Diego real estate:

Get off the sidelines if you have the cash to purchase a home, and remember that you don’t need 20% down. You can get a conventional loan with as little as 5% down, and it is possible to get a good deal in this market with the right agent representing you. It may take writing several offers but you will achieve your goal by being persistent and aggressive. Use the button below to book a free buyer strategy session with me, Lauren Empey, broker/owner of Empey Realty.

If you plan to sell this year, get into action now. The market has never been hotter and you still have time to take advantage of the summer selling market. Once we get into fall, kids go back to school, people get distracted with the holidays, and you never know what will happen that could change the current market, so don’t wait. Use the button below to book a free seller strategy session with me, Lauren Empey, broker/owner of Empey Realty.

San Diego real estate has a very rosy future. I expect sale prices to continue to grow, hopefully at a slower and more reasonable rate than they have so far this year, but overall it’s a great time to invest in San Diego or to cash out if you’re ready to make a move. Let me know if I can help!