What a difference 6 months makes!

This year started off hot as ever, with mortgage rates still around insanely low 3.25%. You'd be lucky if a listing agent responded to you at all, let alone if you could get into a property in time to submit an offer.

Experts at the time predicted mortgage rates would touch 5% by the end of the year—maybe—and price appreciation would slow to a more steady, healthy pace. Instead, due to an unexpected and historically steep surge in inflation, mortgage rates rose at their quickest pace in over 25 years, and exceeded 6% by mid-June.

More...

This shocked the San Diego market, compounding affordability woes on top of sky high property valuations, and masses of buyers dropped out of the market. Within a matter of months, buyers lost hundreds of thousands in buying power. For example, a buyer's monthly payment with 20% down on an $800,000 house at 3.25% was $2785. By June, at 6.25%, that same monthly payment only serviced a purchase price of $562,500! Conversely, at 6.25%, an $800,000 purchase with 20% down would cost $3941 per month (not including taxes and insurance).

Mortgage rates were especially volatile in June. In a case my clients experienced personally, rates jumped a full percentage point between a Thursday when they viewed a house, and Monday when they sat down to actually write the offer. On Thursday, they were thinking of writing an offer for $925,000, and come Monday, the same monthly payment would only service an offer price of $875,000.

As a result, we have seen a lot of price reductions, as sellers have to contend with the fact that buyers can’t afford to pay the same amount that homes were selling for at the beginning of the year, since which time mortgage rates have almost doubled. I have personally seen several homes selling for over $100,000 less than the model match sold for only a few months prior.

Even buyers who can afford the current rate/price combination are reading devastationalist headlines about an imminent crash to the housing market, indeed praying for one, and many are taking a “wait and see” approach.

But just recently, in the past 2 weeks, interest rates settled back down to the low end of 5% and buyers are starting to creep back into the market, and demand has started to rise again.

Economists measure current housing demand by the number of pending sales (homes going into escrow) within the last 30 days.

This can be a misleading indicator when you look at it by price point because if inventory is down in a certain price point, so will be the number of homes in escrow, which doesn’t reflect a true decrease in demand for those homes.

For instance, as values have risen in San Diego in recent years, fewer homes are available in the sub-$500k price range, and therefore “demand” (pending sales) in this price range is lower than last year.

Homes priced below $750k are now considered "lower price point homes" in San Diego (median price is currently $905k for detached homes), and inventory levels and pending sales are down significantly in this price point over last year. This is a combination of the reduced available inventory valued at less than $750k, and the change in affordability due to rising mortgage rates, but one thing is for sure: the impact of higher home values plus higher interest rates is hitting buyers in the lower price points the hardest.

Cash buyers and investors, on the other hand, are the strongest segment of the market that is still driving demand, and there is still a lot of cash flowing into San Diego real estate. Investors recognize that San Diego is a place that a lot of people want to live, we continually gain population, and rents continue to rise. I don’t see this segment of the market disappearing anytime soon, and indeed, these cash buyers will be best positioned to take advantage of price corrections as we get into fall and winter, which tends to be the slowest part of the yearly real estate cycle.

At the same time that many buyers started dropping out of the market, overall inventory finally began to rise. Overall inventory in San Diego County in June was 18.7% higher than last year, and currently sits at 4798 units. In the $750k-1,000,000 price point, June inventory was up 58.5% over last year, and in the $1-2M price point, inventory is up more than 65% over last year. But, these current levels are still around 53% lower than the 3-year average prior to Covid.

Demand has picked back up in the past few weeks, as rates settled back to the low end of 5% and buyers are encouraged by seeing more price reductions, but even homes that are priced right and show beautifully are taking much longer to sell because supply overall is much higher than it was at the beginning of the year, there are fewer buyers, and buyers have more options.

I have had a couple listings recently that are priced well below the recent sales, marketed right, and all the buyer feedback has been positive, and they are still taking a few weeks, if not longer, to go into escrow. Part of that also is the fact that everyone is traveling right now after travel plans have been stifled during the past two years, and I expect that demand will continue to pick up as summer vacations wind to a close and San Diegans get back to business as usual.

Normally housing inventory would peak in October, but as demand has begun to revive after the June market shock, it is keeping up with the increasing supply and the supply level is starting to plateau. If supply and demand keep moving in the same direction at the same pace, we may see the inventory peak in August or September. It will be interesting to see how many new listings we get in the next two months.

The luxury market (homes priced at $1,500,000 or above) has been the strongest growing segment of the San Diego market in the past two years, and even this sector has seen a significant increase in supply and reduction in demand in recent months.

Inventory now sits at its highest level since August 2020, and is 29.2% higher than in July of last year. Meanwhile demand is down 18% over last year, a change that many attribute to the recent volatility in the stock market. Overall, the expected market time for luxury homes has increased significantly.

The median detached home sale price in San Diego in July was $905,000. Median sale prices are usually calculated using a 12-month rolling average, so as to not skew the statistic if a super expensive home sells during the past month. However, the rolling average really doesn’t tell the whole picture of what is happening on the ground, and of course, real estate is hyper local, so values will be impacted by this changing market differently in different San Diego neighborhoods.

High-demand/high-price areas like the coastal zip codes are not feeling quite the correction that we’re seeing elsewhere, partially because these areas already attract a large percentage of cash buyers and very wealthy people, who are not as sensitive to the pressure from mortgage rates, but these impacts (longer market times and price reductions) are being seen in all areas and price points.

On a rolling average basis, we’re not going to see a reduction in overall home values. We saw these market conditions in the end of 2013/beginning of 2014 and end of 2018/beginning of 2019, when mortgage rates rose above 5% and demand slowed considerably, there were lots of price reductions and longer market times, and yet overall homes values increased 6% in 2013-2014 and 3% in 2018-1029.

However, on a house-by-house, neighborhood-by-neighborhood basis, sellers need to be realistic about the fact that the peak has come and gone. Buyer’s aren’t out here overpaying for homes by hundreds of thousands of dollars just to lock in a 2.99% interest rate anymore.

Currently in San Diego, 37% of listings have price reductions. Some were overpriced to begin with, with sellers being slow to acknowledge the change in market demand. There are always sellers out there who think their property is worth more than it is, or have an attitude of “price it high because I can always reduce the price later.” The other group of these price reductions are sellers whose target buyers are normal, middle class people who simply can’t afford those prices anymore at current rates, and sellers are making concessions to get the deal done.

For financed buyers, the current price adjustments aren’t providing much relief yet, since their monthly payments are largely the same at the new interest rates even after a price reduction, but there are reasons to be encouraged that there will be opportunities to refinance in the future at a lower rate. Read on for the mortgage market forecast at the end of this post.

I think the rest of this year, going into March of next year, will provide the best opportunities for buyers to get a good deal on a home or investment property before the real estate market kicks back into high gear in spring 2023.

The main driver behind mortgage rates is inflation, and with inflation jumping to its highest level in 40 years, this is why mortgage rates have been more volatile in the last few months than they’ve been in over 25 years.

When inflation is high, money becomes less valuable, and mortgage companies worry about consumers' ability to repay their debts, and they have to charge more to borrow as a result, to mitigate that risk.

Initially, when the Federal Reserve started to raise the short term borrowing rate, it wasn’t clear yet how significant inflation was or whether it was “transient,” as the Fed was promising. The drastic action being taken by the Fed at first made mortgage companies nervous that inflation wasn’t transitory, and rates started jumping as a result. This happened over the next few Fed meeting cycles, until it became undeniably evident that inflation is out of control, at which point the mortgage rates had already adjusted upwards to price that in.

The two most recent basis point increases by the Fed actually gave the mortgage industry some comfort and confidence that the Fed is taking serious action to repair this out of control inflation, and mortgage rates decreased after each of the two recent basis point increases by the Fed.

Rates are now slightly above 5%, and because the environment is so volatile, they can vary significantly from lender to lender, but in general, this is still a historically low mortgage rate and a great place to start because more than likely, buyers today will have chances to refinance in the future as the economy goes through its normal cycles.

The final impact of this super high inflation is that it continues to drive demand for real estate investments, because real estate is a time-honored hedge against inflation and typically continues to increase in value during inflationary periods.

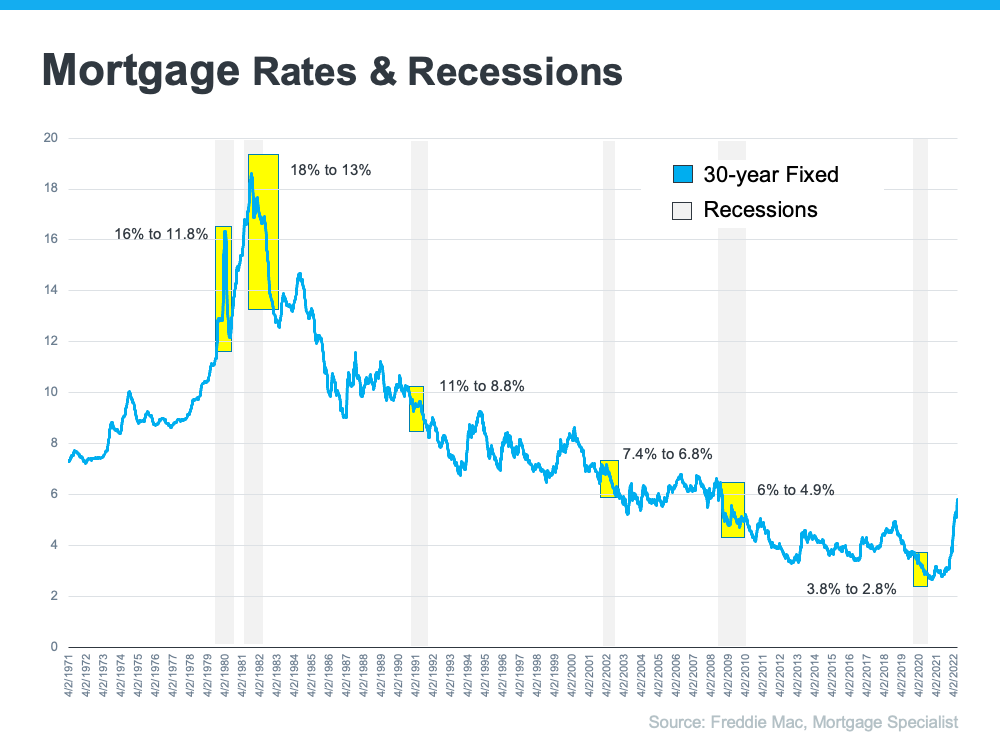

Regarding a potential recession, this too will actually help the real estate market rather than hinder it, because mortgage rates always go down during a recession.

Historical Mortgage Rates During Recessions Chart

When people get nervous about the stock market and start putting more into mortgage backed bonds, that also drives rates down. So even if we truly are going into (or already in) a recession, overall home values are not going to drop.

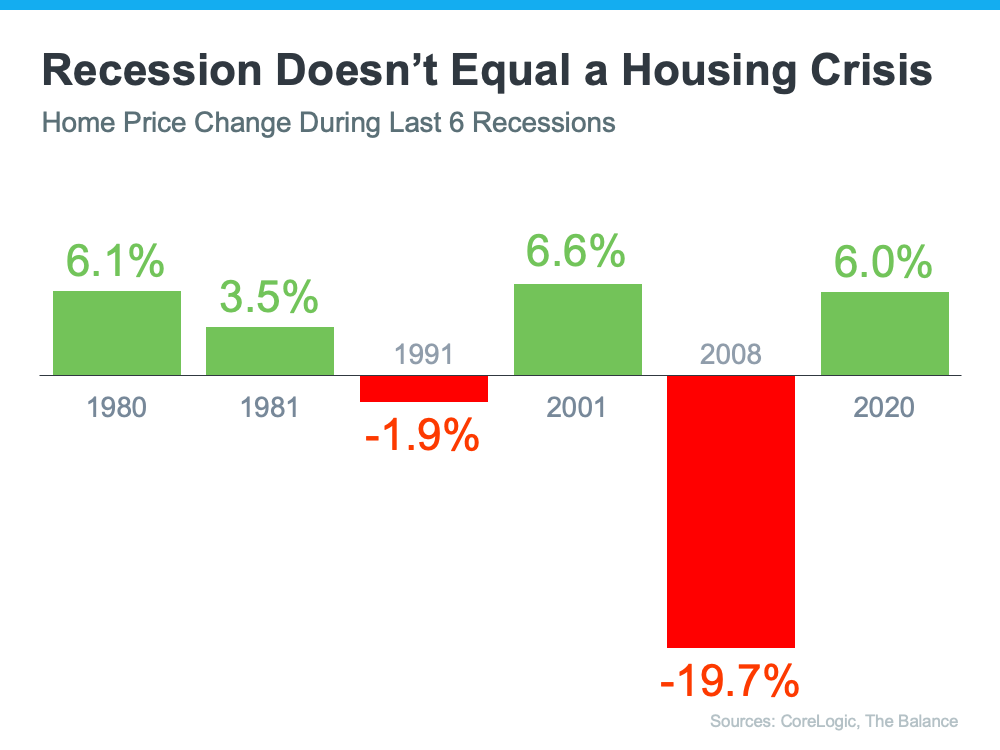

Home Values Change During Last 6 Recessions Chart

Home values only dropped during the savings and loan bust in 1991 and the 2008 recession because of irresponsible lending practices at those times. Conversely, now, lending standards are higher than they’ve ever been, and borrowers are more qualified and sitting on more equity than they’ve ever been, so there is a very low likelihood of any kind of housing “crash.”

Although the market dynamics between buyer and seller are changing, we’re nowhere near being in a “buyer’s market” yet.

To determine whether it’s a buyer’s market or a seller’s market, typically we look at the “absorption rate,” which is defined as the speed at which all housing inventory would sell out at the current selling rate (measured by pending sales in the last month), if no additional inventory came to market.

For instance, right now there are 4798 housing units available for sale in San Diego County. 1976 units have gone pending in the past 30 days, meaning that if 1976 units are selling per month, it would take 2.43 months, or around 73 days for all of the available housing to be “absorbed” at the current buying pace. Last year at this time, all available inventory would be absorbed in 28 days, which was almost instantaneous.

In general, anything under 90 days for an absorption rate is a seller’s market. From 90-120 days is considered a balanced market, and once you get to a level of inventory that will take longer than 120 days to completely sell out at the current buying pace, you have entered a buyer’s market. We haven’t had that level of inventory vs demand in San Diego since the crash of 2008.

So we’re not in a buyer’s market yet, and inventory is still well below historical levels, but if inventory continues to rise, and demand does not, we could get closer to a truly balanced market.

However, if we do go into a recession, as many predict, and the Fed is able to get inflation under control, both of these factors will drive mortgage rates down, which will in turn fuel demand, so it’s very unlikely that demand will fall to the level that would put us into a buyer’s market, or even a truly balanced market.

The best buyers are going to get in the perpetually high demand San Diego real estate market is right now, going into the end of the year. Buyers should capitalize on everyone else’s worries and other buyers waiting on the fence. The closest we’ve been to this supply/demand dynamic in the past 10 years was the end of 2018, when mortgage rates topped 5% and the absorption rate got close to 120 days, and there were deals to be had, and opportunities to refinance after. And home values still went up, albeit only 3% that year, but that’s still better than losing 9% of the value of your cash due to inflation.

The market has changed, a lot, and thankfully, because it was completely insane and irrational the past 2 years. We are seeing similar homes sell for significantly less now than they did a few months ago. However, a crash is still not coming.

If we go into a recession, coming from where we are now with mortgage rates in the low 5% range, we'll likely see rates drop back down to the low 4% range, which will further reignite buyer demand. This will likely happen in the spring of next year, just in time for peak buying season. And if the Fed is able to get inflation under control, that will further take pressure off mortgage rates, and fuel demand. The best we can hope for to reach a more balanced market is that people will continue to list their properties for sale and we can get closer to a pre-Covid level of housing inventory.

If you’re not motivated to sell your property, don’t bother. It’s not the market to list and “see if you can get your price.” On the other hand, even if you’re not selling for the absolute top dollar that your neighbor did a few months ago, you’re still sitting on around 30% more equity than you were 2 years ago, and that should still feel pretty good.

If you want or need to sell, you’ll need to be realistic about pricing your property competitively compared to the active competition, and largely ignore the recent past sale data, because that market is gone. You’ll also want to be realistic about how long it will take to sell, and hire a really good real estate agent to extensively market your property. Listen to their advice about repairs and staging. Position yourself to be the best value in the market, because buyers have more choices now than they have had in the last two years.

And if you need to sell your home in order to buy a new one, these opportunities are finally opening up for you. My team has been helping clients succeed with these incredibly delicate maneuvers and it is once again becoming possible with the right agent on your side.

If you’re not in a rush to sell, I think things will pick back up in Spring of 2023, so you may want to get in touch with an agent now to figure out what updates or repairs you need to make in order to be ready to list in March/April, because supply chain issues are still making renovations take forever.

The rest of this year and into the beginning of next spring will be your best opportunities to get a good deal. There will always be sellers who need to sell and who overprice their property. Overpricing is the kiss of death and once a home has been on the market for 1-2 months because it’s overpriced, all the other buyers will think there’s something wrong with it, and your negotiation power is at its highest possible level.

The holidays are always the best time to get a good deal, and I think this will be compounded this year with other buyers dropping out of the market due to fatigue or being priced out by current mortgage rates.

Get your loan preapproval in place and start watching the market. Ask your agent for a referral to a direct lender who can offer shortened escrow timelines, which makes your offer more competitive and puts you closer to competing with cash offers. Do not default to your retail bank or credit union because these institutions have too many other facets to their business and cannot move as quickly as lenders who only do home loans.

There is still a lot of cash in the market, so you want to position yourself to be able to make attractive, competitive offers, and if you are a cash buyer, you are in the best possible position to take advantage of this changing market and reduced affordability for normal, financed buyers.

All of the lenders I am speaking with believe there will be chances to refinance in the next few years and reduce your interest rate by at least a percentage point, so I honestly think we are going into a great time to buy, and I will be looking for investment opportunities for myself and my clients.

Whether you are thinking of buying or selling, use the button above to set up a free strategy session with me, Lauren Empey, real estate broker and owner of Empey Realty, and I’ll help you set up a personalized plan to achieve your goals.

To your success!

* All data referenced above was either compiled by Quantitative Real Estate Economist, Stephen Thomas, or researched by me directly from the San Diego MLS.