In the last installment of our blog series on How to Buy a Home in California, we went over some basics about the standard home purchase contract in California. By now you have a pretty good understanding of what you're getting into, and it's time to start interviewing Realtors and kickstart your home search into high gear! In this post, we'll give you some great tips on how to make sure you hire a stellar Realtor. If you want to browse through the topics in this series, please use our handy Table of Contents.

More...

What is a Fiduciary Duty?

This is the first question you should ask any potential Realtor because guess what?? When you hire a Realtor they become your fiduciary and they owe you a fiduciary duty—the highest legal duty one human can owe to another. It's the same duty a trustee of a trust has to make sure that everything they do is in the best interest of the trust. The fiduciary duty your Realtor owes you obligates them to put your best interests above and beyond all else, and to treat you with complete honesty and candor. They also owe you a duty of loyalty, meaning they must disclose to you all material facts, must disclose and avoid all conflicts of interest, and never engage in self-dealing. YOUR best interests are the only things that should be considered.

If your Realtor can't quickly explain this duty, you can't expect them to uphold it when representing you in your home purchase. Unfortunately, there are a lot of reckless real estate agents out there. Either they don't know about the gravity of these duties, or they're out for a quick buck and don't care. But don't worry. By asking this question first, you'll weed out the bad, and find a great agent who takes their craft very seriously.

When you hire a Realtor to help you buy a home, it has to be a partnership based on mutual trust and honesty in order to work. Go here for 7 interview questions you should ask before you hire a Realtor.

Recent Changes to California Real Estate Laws You Should be Aware Of

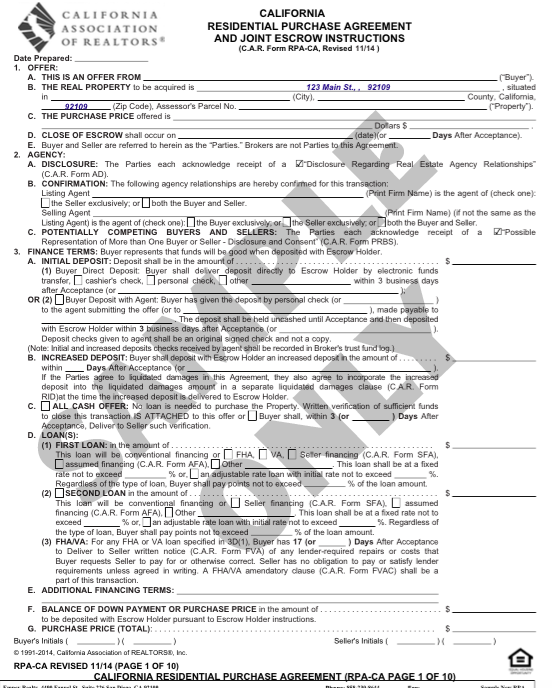

A lot of laws relating to the sale of real estate in California changed in 2015. In anticipation of these changes, the Residential Purchase Agreement (the "RPA," the standard form contract written by the California Association of Realtors, which is used in almost every home sale in California) was completely overhauled. There are significant changes that affect buyers. You want to make sure your agent is the type of professional who makes it a priority to keep up on changes in the law and the market and to be constantly educating themselves. (For the basics on the RPA, click here.)

Ask any agent you may be thinking about hiring their opinion about the most important changes to the RPA that affect buyers. For frame of reference, potential answers could include the following:

- The Wood-Destroying Pests Addendum. This is a huge change that adversely affects buyers. Seven months ago, this addendum was attached to the RPA as a matter of standard practice, and as a matter of practice, the seller would agree to pay for any damage discovered during escrow that is caused by termites, dry rot, or other wood-destroying pests. The recent changes to the standard form contracts eliminated this addendum altogether. It doesn't exist anymore. Now, your Realtor has to specifically write these terms into the contract. But the problem is, now it seems like you're asking for something extra. With the previous addendum, with the check boxes filled out in the standard way, buyers got a huge leg up. Now that's done.

- Buyers Must Secure Stated Financing. The seller can now cancel the deal if you try to change your financing as specified in the contract. Bottom line, be honest with the seller about how you're going to pay for the property. In today's market, every seller will require a pre-approval letter from your lender, accompanied by proof of funds (a bank statement showing you can pay for your down payment and closing costs), before they will accept your offer. For all-cash buyers, you will have to supply proof of funds as well, at most within 3 days of submitting your offer.

- Sellers Can No Longer Force You to Pay for Outrageous HOA Document Fees. HOAs are notorious for being difficult. If you're buying a property subject to an HOA, sometimes they try to charge exorbitant fees—like $500—to produce the documents the seller is required by law to provide to you (even if they already have them in electronic format). In the past, the seller would try to pass those ridiculous costs on to you. Now, the law has been changed to specify that it's the seller's responsibility to pay those document preparation fees. And that means $500 less for your closing costs.

Market Knowledge

Finally, you want to make sure your agent is fully immersed in the current market, so they know how to properly advise you. Do yourself a favor and hire someone who makes this their business full-time. It's tempting to work with your friend or relative who does real estate "on the side" for extra cash, but for one of the most important financial transactions of your life, you need to protect yourself. The laws are always changing, and the market can change drastically within a matter of days or weeks. Someone who does real estate part-time probably doesn't have the most accurate and up-to-date information.

There are other reasons you may not want to hire your friend or family member. After all, if something goes wrong, it makes for a very awkward Thanksgiving dinner. If your friend or relative is going to be really offended that you've hired someone else, your agent may be able to allay those hurt feelings by offering them a referral fee. Money always helps!

Ask your agent about what challenges are present in the current market that weren't present last month, 3 months ago, and what changes we should anticipate in the near future. You can also test your agent's local knowledge by asking them what government retrofit requirements may apply to your home purchase. These can vary by city, county or state. For instance, in the City of San Diego, when you sell a 1-4 unit property, you're required to retrofit all of the plumbing fixtures to low-flow water conserving fixtures, and sometimes sellers try to pass that responsibility on to the buyer. This includes toilets, faucets, and shower heads. You may purchase a home within San Diego County that's in another city, like La Jolla or La Mesa, and other municipal retrofit requirements may apply. This question is a great test of your agent's local expertise.

Keep reading here, at How to Buy a Home In California, Part V, where we'll be going over the basics of how home loans work in California, and how to make sure you get the best rate and terms. Thank you for sharing and leave us any questions or comments below!